Staking is a great way to create a passive income with your crypto assets. Top PoS blockchains have paid tokens worth billions to investors for actively securing their network by staking their acquired tokens.

Because PoS (Proof Of Stake) blockchains are proven to have clear advantages over those that rely on the conventional PoW (Proof of Work) consensus mechanism, the “Staking industry” is becoming increasingly popular and subsequently bigger.

Article Series (7 of 7)

This is the 6th article in our series relating to the purchasing, trading, and staking of Akash ($AKT). If you are just discovering this article series, you may want to review our previous articles to understand the complete steps;

- How To Purchase Cryptocurrency (Via BankdraftS) using Coinbase.

- How To Purchase Akash Tokens ($AKT) Using Gate.io.

- How To Stake Akash ($AKT) via Keplr.

- How To Stake Akash ($AKT) via Cosmostation Web Wallet.

- How To Stake Akash ($AKT) via Cosmostation Mobile App.

- How to Stake Akash ($AKT) via the Akash Command-Line-Interface (CLI).

- Potential Earnings With Staking: What To Expect?

If you're reading this post, it is likely because you are exploring income opportunities with staking. However, if you've just come across this term (Staking), we recommend starting out by reading our staking guide here: What Is Staking?

Is Staking Safe?

Let's start with the most common concern – is Staking cryptocurrency safe?

The short answer is: yes, it is.

Staking is a process essential to the functioning of any blockchain-based ecosystem that relies on the PoS consensus mechanism. It is not exclusive to the blockchain ecosystem. In other words, by Staking your tokens you're not getting involved with any new or third-party enterprise. Basically, with Staking, all you are doing is to effectively lend or leverage your acquired tokens to help create new blocks necessary to validate transactions on the same blockchain.

If you're confident acquiring a token, you should be more than confident to Stake/Delegate them to secure the blockchain and earn rewards in the process.

What Are The Risks?

Staking is risk-free if it's done the right way.

Here are a few things you should be careful about before you start purchasing and staking cryptocurrencies:

- Staking tokens with unverified projects: We recommend and encourage our staking partners/ delegators to conduct thorough due diligence before getting involved with any project. Though Staking as a process is the same for all blockchains that follow the PoS consensus mechanism, the projects you get involved with must demonstrate stability, and potential.

- Do it, only if you know it: Becoming a “validator” and staking is indeed profitable but if you're planning to become one yourself, you must have experts to assist or some experience running a validator node. Also, becoming a validator is not a part-time affair, it requires both high-level expertise and dedication. Therefore, if you're a retail investor, we strictly recommend delegating your tokens through a verified and trusted Validator. This is where ValidatorNode's Staking-as-a-Service (SaaS) plays a vital role.

- Only use Verified And Listed Validators: You must delegate your tokens only to verified and trusted Validators for a network. To delegate your tokens, Validators do charge a certain percentage (known as a commission) of the profits you'll make but that's for a reason. These commissions go towards maintaining the staking infrastructure and facilitating seamless staking which requires expert supervision and monitoring. You mustn't fall for commission-less staking services or for rates that are too good to be true. That should be a red flag.

- Using Private Wallets: At ValidatorNode we always recommend you use private wallets when Staking and not to leave high amounts of tokens on exchange wallets. Usually, high-end crypto exchanges do offer a very secure online wallet, but private wallets provide an extra layer of security and are simply less vulnerable.

Creating A Passive Income By Staking Cryptocurrencies

You can easily create a passive income by staking your acquired cryptocurrency tokens. Because not all projects are the same, different tokens offer different APY (Annual Percentage Yield). Staking yields can be as low as 1% and as high as 60-70%. Currently, the majority of the top 30 PoS tokens seem to offer not more than 7-8% on average.

Younger projects tend to offer significantly higher than their already saturated and mature counterparts. However, even the bigger projects like Polkadot and Cardano did offer higher APY to the early adopters. It's no secret that the key to making the most of Staking cryptocurrencies is to make prompt investment decisions and investing early.

Akash Network Staking Potential

That said, making a decent passive income by staking cryptocurrencies and without having to sell them is easy. At ValidatorNode we provide our delegating partners with the best staking opportunities. Currently, we have partnered with the highly promising Akash Network. We have $AKT tokens worth over $5 million (USD) staked on the Akash Network at the time of this article.

Akash Network is the world's first decentralized cloud services provider which allows developers to host websites, applications, and more at a fraction of the current costs of other cloud providers. Akash is doing so by creating a decentralized network where the underutilized capacity of thousands of data centers across the globe can be leveraged, sold, or utilized to their full potential. Akash tokens ($AKT) are the native tokens of the Akash Network and they act as an engagement tool between the stakeholders in the ecosystem.

How Much Can I Earn Staking $AKT

We are a trusted validator with the Akash Network because we believe in its potential. Currently, the Akash Network is offering a promising APY of ~53% (with a 7.5% commission). However, it may not remain the same and is likely to change soon.

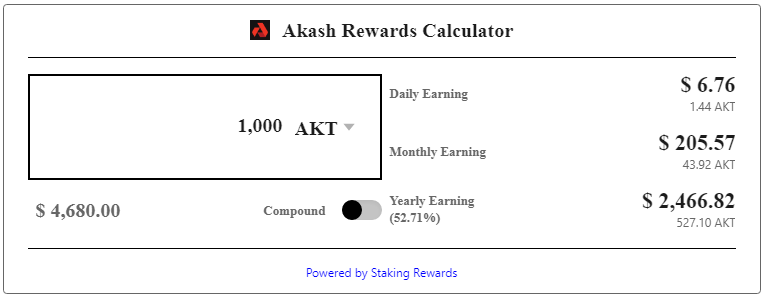

Over 84% of Akash tokens issued are currently staked. Here's a quick breakdown of earnings potential you can expect staking 1000 ($AKT) purchased at USD $4.68 per token (as of 05/17/2021).

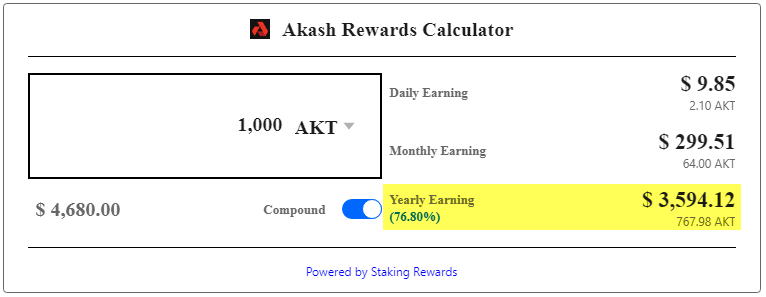

Please note that your total annual returns could be much higher than the promised ~53% APY if you take advantage of the power of compounding (earning rewards from rewards). The following reflects the power of compounding and what it means to your potential earnings from staking.

As you can see, your earnings increase exponentially when you take advantage of the power of Compounding. In our example above, Your APY increase goes up to ~77%!

(Note – the frequency of reinvesting and thus compounding your rewards is a topic of another article.)

Furthermore, other technical factors contribute towards maximizing your profitability from staking. For example, it is crucial to have the highest possible uptime to earn maximum rewards. Security of the staking network is something that you can't afford to compromise with.

Note: Validator Node is a trusted staking validator with the Akash Network. We provide a 99% uptime which allows us to let our staking partners/delegators benefit the maximum. To learn more about staking Akash Tokens please refer to our comprehensive set of staking articles.

Summary

Our Potential Earnings With Staking: What To Expect article is meant to get you thinking about the benefits of staking, along with the details and methods that you can use to compound your earnings via staking and increase your profit potential on staked Akash ($AKT) over 77% APY. This article is part of a series of articles that we are publishing to assist users of Akash ($AKT) and to help raise the awareness of Akash.

About Akash

The Akash Network (Akash) is a secure, transparent, and decentralized cloud computing marketplace that connects those who need computing resources (clients) with those that have the computing capacity to lease (providers).

Akash acts as a “super” cloud platform (supercloud) – providing a unified layer above all providers on the marketplace to present clients with a single cloud platform, regardless of which particular provider they may be using. Clients use Akash because of its cost advantage, usability, and flexibility to move between cloud providers and the performance benefits of global deployments. Providers use Akash because it allows them to earn profits from either dedicated or temporarily unused capacity.

About ValidatorNode

ValidatorNode is a fast-growing network of validator services. Having successfully partnered with the promising Akash Network we now have more than 10 million dollars worth of delegated crypto assets. Our innovative staking-as-a-service (SAAS) model allows retail investors/individuals to leverage their cryptocurrency tokens and earn profits. As a community-driven enterprise, we believe in mutual growth forging meaningful partnerships.

ValidatorNode “Delegator Partners” benefit from the highly secure and advanced and updated features of the ValidatorNode ecosystem. You make the maximum while we ensure seamless continuity and scalability of the validating and staking process.

Comment on Our Post