Gone are the days of Initial Coin Offerings (ICO's) where “price pumps” and “rug pulls” were common. Welcome, LBP's, the new method for determining the market price of a new cryptocurrency.

LBP's (Liquidity Bootstrap Pools), which were introduced in 2021, enables a new method for crypto price discovery without price volatility. LBP's prevent flash sales or aggressive arbitrage that would lead to rapid exchange rate fluctuations.

Comdex has announced that it will utilize an LBP, with the assistance of the Cosmos Osmosis DEX (Distributed Exchange), to set the fair market value of its cryptocurrency known as $CMDX.

Everything you wanted to know about LBP's

LBPs are a great solution for new cryptocurrencies who wish to get coins into the hands of their user base without the limitations of a rapidly increasing price curve and the possibility of large investors (aka whales) skewing the price resulting in pump and dump tactics.

An LBP contains a minimum of 2 assets, the asset ratios are determined by the price variances of a set of known assets and a projected price of the target asset. LBP's operate within a defined period of time. The ratio of the assets in the LBP adjusts at fixed intervals over a defined period of time to facilitate price discovery for the target asset.

The target asset is initially listed at a pre-defined price ceiling, then a price ratio is calculated corresponding to the relative weightage of the assets in the pool. These weights are then programmed to gradually decline, causing the target assets price to decline, allowing interested buyers an opportunity to choose the fair price at which they wish to enter the market. As the price declines, it is natural for a larger number of buyers to place orders to get involved. This process continues until the final weightage of the assets is met and all the available assets have been bought.

It is important for interested individuals to understand, that an LBP is designed to start at a high price and gradually fall. The ultimate aim is to let the community of buyers decide the price that they consider fair before buying in.

Comdex LBP Hypothetical Example

(Liquidity Bootstrap Pool)

Before we get started with a hypothetical overview of the Comdex LBP, we need to understand the yet unknown variables. These variables will be announced by the Comdex team as the LBP start approaches.

The unknown variables which play an important part in the LBP are these;

- Variable SP – Starting Price of Comdex for the LBP

- Variable OA – Other assets to take part in the LBP

- Variable PR – Price Ratio between all Assets

- Variable LN – LBP Duration

- Variable TA – Total number of Comdex Assets offered during LBP

With the unknown variables listed out, we can now begin to make some assumptions for our hypothetical LBP scenario.

“Keep in mind this scenario is designed for educational purposes.”

For our scenario, we will assume the following values for our variable defined above;

- SP = Starting price of the Comdex ($CMDX) coin = $75.00 USD

- OA = The Osmosis coin ($OSMO)

- PR = Price Ratio between $CMDX and $OSMO (OA)

- LN = 7 Days

- TA = 3,000,000 $CMDX

We can start by reviewing the Osmosis Zone website to find what the current market price of $OSMO is. The price is listed on the “Pools” page at the top of the page.

At present, 1 $OSMO = $5.33, so that provides us with what we need to calculate the ratio between our opening $CMDX price and the $OSMO price. To simplify our ratio we are going to round the $OSMO price to an even OA=$5.00. This gives us a ratio of 500:7500 or a simplified ratio of 1:15. Thus, we will set our PR = 1:15.

Now that we have some known values for our variables. Let's walk through our scenario of how the Comdex LBP may unfold.

At the Launch of the Comdex LBP

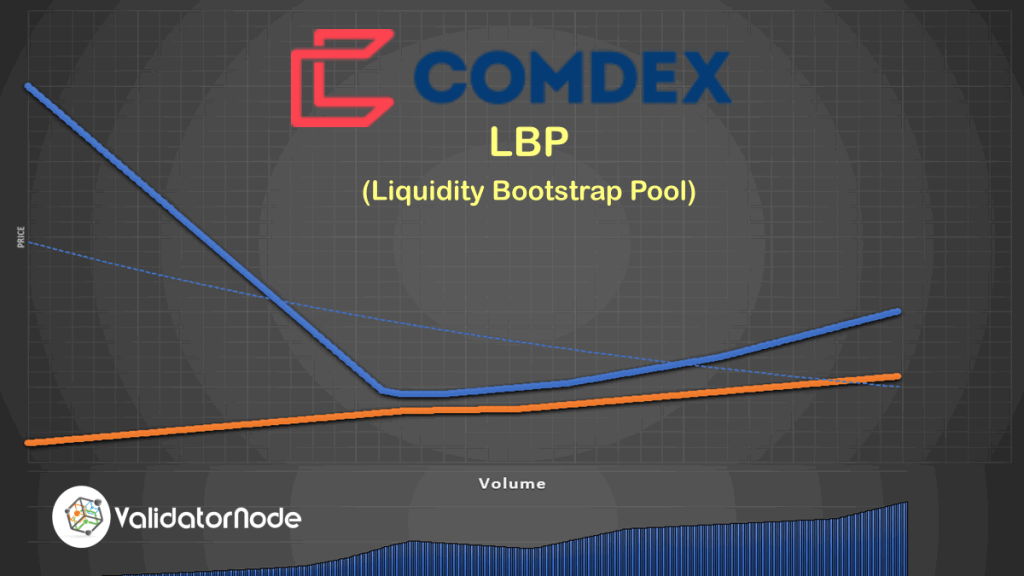

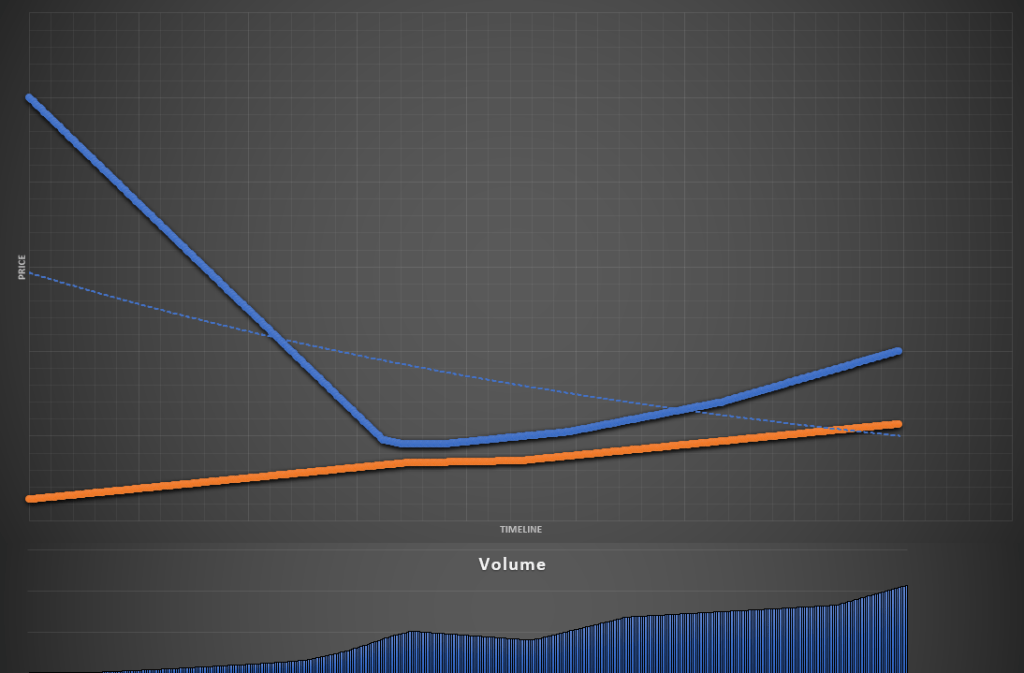

The initial $CMDX price discovery on Osmosis will be held as a variation of a reverse Dutch auction. However, for our scenario, we have defined this price as SP=$75.00. Represented in the chart below as the blue line.

In a normal competitive market, where the price starts low and is bid higher by traders. The Comdex LBP will start with a higher based price using our ratio of PR. The LBP begins with the higher ratio (1:15) which will adjust over time. As the ratio adjusts, the price of $CMDX will adjust downward.

Buyers have the option of entering the trading activity at any point during the LBP (shown as the volume in our chart). Most buyers have a preconceived idea of what the price of $CMDX should be, those buyers can begin buying $CMDX when their pricepoint is reached.

During the Comdex LBP

While the LBP is active the ratio between the SP and OA will be reflected in the PR and the PR will be adjusted. As the ratio adjusts closer to the OA price ($OSMO price as depicted with the orange line in the chart) the $CMDX price discovery will be realized.

As a buyer, it is up to you to determine what pricepoint you think is good to enter the market. Buyers purchase $CMDX at whatever pricepoint they believe $CMDX is worth. It's important to note if you wait too long, the LN could be reached or the TA could run out. If this happens, you may miss out on the ability to purchase $CMDX during the LBP.

Comdex LBP Completion

Once the LBP completes, the price of Comdex $CMDX will be established and trading will commence. Shortly thereafter, we will see Liquidity Pools LP's show up on Osmosis and other DEX's.

It is not uncommon for the price of the listed asset (in this case $CMDX) to increase once price discovery is reached. This activity has been reflected in our chart, along with the increase in the volume of trading.

Summary

We have been told by the Comdex team that the LBP is imminent and could begin at any time. Therefore, with our scenario of what you might expect from the Comdex LBP, you should be adequately prepared to participate in the LBP once it begins.

About Comdex

Comdex was established with the goal of Democratizing Finance and making finance globally accessible. Comdex is an ecosystem of solutions to democratize finance and bridge DeFi and CeFi.

Comdex journey towards opening financial markets and growing investors' access progresses by creating the synthetics protocol. Through synthetics, Comdex will innovate to enhance investors' access to a broad range of asset classes and generate a higher yield from safer avenues for investment.

Comdex's journey started with a vision to create interoperable solutions to access financial products and services in the commodities space. Launching their protocol on the Cosmos ecosystem seemed like the natural first step in realizing this goal. They are keen on building solutions that will bridge the gap between DeFi and CeFi. Their decentralized synthetics protocol brings efficiency, transparency, and trust to commodity and trade finance industries.

Through synthetics, Comdex provides seamless access to global assets and liquidity. They are innovating to enhance investors’ access to a broad range of asset classes. A truly permissionless system like this can facilitate the tokenization of real-world assets with fewer hurdles than those in the traditional derivatives markets. Their MainNet launched on Nov. 20th, 2021.

About Osmosis

The advent of automated market makers (AMMs) brought forth a new wave of crypto-economic utility and applications of bonding curves. Today, AMMs has become such an integral part of blockchain’s use-case that it’d be hard to imagine what the crypto space would look like without it. Osmosis is an advanced AMM protocol built using the Cosmos SDK that will allow developers to design, build, and deploy their own customized AMMs.

Heterogeneity and sovereignty are two core tenets of the Cosmos ecosystem, and Osmosis takes these two values and extends them into core characteristics of this AMM protocol. Rather than aim for a one-size-fits-all homogeneous approach for AMMs and their liquidity pools, Osmosis is designed such that the most efficient solution is reachable through the process of experimentation and rapid iteration by leveraging the wisdom of the crowd. It achieves this by offering deep customizability to AMM designers, and a governance mechanism by which each AMM pool’s stakeholders (i.e. liquidity providers) can govern and direct their pools.

About ValidatorNode

ValidatorNode is a fast-growing network of validator services. Having successfully partnered with the promising COMDEX Network we now have more than 15 million dollars worth of delegated crypto assets. Our innovative staking-as-a-service (SAAS) model allows retail investors/individuals to leverage their cryptocurrency tokens and earn profits. As a community-driven enterprise, we believe in mutual growth forging meaningful partnerships.

ValidatorNode “Delegator Partners” benefit from the highly secure and advanced and updated features of the ValidatorNode ecosystem. You make the maximum while we ensure seamless continuity and scalability of the validating and staking process.

Comment on Our Post